Berlin moves to permanently cut electricity tax for industry and agriculture and to subsidize transmission grid fees in 2026. The package signals a turn from performative climate policy toward cost realism to keep factories at home.

It would appear that the last decade’s fever dream of symbolic environmentalism is winding down. In Germany, at least, Greta Thunberg’s spirit animal will be working with a narrower list of targets to haunt.

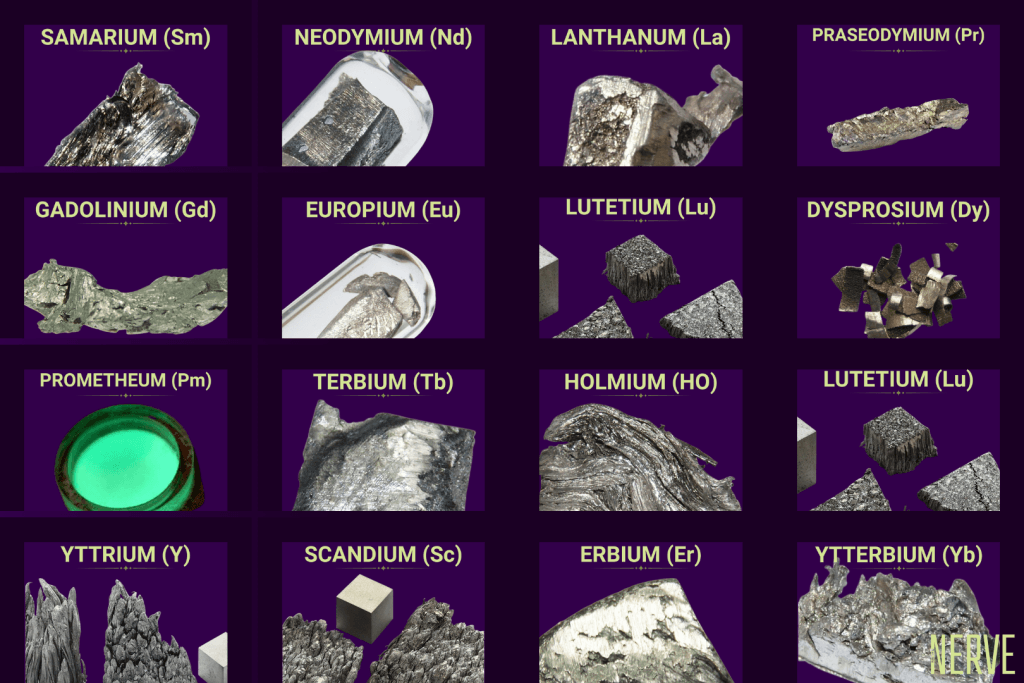

Call it the EROI principle. Energy Return on Investment measures how much usable energy you get out compared with the energy put in to obtain it. High-EROI sources leave a surplus that powers manufacturing, logistics, hospitals, and R&D. Low-EROI sources can keep your lights on in a handful of homes but offer scant surplus for heavy industry.

What changed (cabinet decisions on 3 September 2025)

- Electricity tax (Stromsteuer) cut is made permanent for the producing industries and agriculture/forestry at the EU minimum rate. The Finance Ministry pegs the fiscal effect at €1.5 billion in 2026, rising to €3 billion per year from 2027 as the measure fully phases in.

- Transmission grid fees (Übertragungsnetzentgelte) will be subsidized with €6.5 billion in 2026 from the Climate and Transformation Fund, with the intent to dampen power bills for households and businesses next year.

- Gas storage levy is abolished as part of the broader relief mix referenced by the government.

- The measures landed as part of a cabinet bundle that includes the Third Act to amend the Energy Tax Act and Electricity Tax Act; the formal text now moves to the Bundestag.

- Winners: more than 600,000 firms in energy‑intensive and trade‑exposed sectors (chemicals, metals, autos, machinery) plus agricultural producers. They pay the EU‑minimum electricity tax going forward and get grid‑fee relief in 2026.

- Partial relief for households: the grid‑fee subsidy should pull down bills next year. Households do not get the permanent electricity‑tax cut; consumer groups are already challenging the asymmetry.

The American angle

For the U.S., this is competitive pressure in plain view. If Germany structurally lowers industrial power costs while maintaining climate targets, U.S. utilities and state regulators will face louder calls for long‑term industrial tariffs, site‑ready baseload, and predictable interconnection timelines. The question isn’t ideology; it’s Energy Return on Investment (how much usable energy the system delivers per unit invested). Cheap, reliable power is the raw material of manufacturing. When a G7 peer moves to hard‑wire lower non‑energy price components (taxes, grid‑fees) and protect energy‑intensive exporters, American planners can’t assume Europe will price itself out of the game.

Why Berlin is doing this now

German industry has bled competitiveness since 2022 under a triple squeeze: expensive gas, rising grid fees, and policy risk around electricity taxes and levies. Americans should note that these aren’t concerns arising from acts of God or infrastructural barriers. These were policy decisions, arbitrary and synthetic.

By locking the power tax at the EU floor for factories and buying down transmission fees for 2026, the government is signaling a pivot to price realism, accepting that unit energy cost is industrial policy. The move also aligns with the parallel Franco‑German agenda to secure an industrial electricity price and expand air‑defense and strategic tech initiatives, an implicit acknowledgement that Europe needs a cheaper, firmer power base to rearm and reshore.

By the numbers

- €6.5 billion: 2026 federal subsidy to transmission‑system operator fees, intended to dampen grid charges across the board.

- €1.5 billion (2026) to €3 billion/year (from 2027): foregone revenue from the permanent electricity‑tax cut for industry/agriculture.

- 600,000+ companies: scope of firms directly covered by the tax measure.

- Timing: grid‑fee relief applies in 2026; the electricity‑tax change is permanent and budgeted to scale to the full annual amount in 2027 after the first year’s partial‑year effect.

Pushback and support

- Unions/Industry: Major industrial unions have welcomed the package as overdue relief for production sites, arguing it stabilizes investment decisions after two volatile years.

- Consumer advocates & SMEs: criticize the exclusion of households and many service‑sector SMEs from the tax cut, warning of perceived unfairness if the grid‑fee subsidy doesn’t fully pass through to retail bills.

- Utilities & grid operators: urge fast‑track passage so 2026 tariffs can be calculated and published on time.