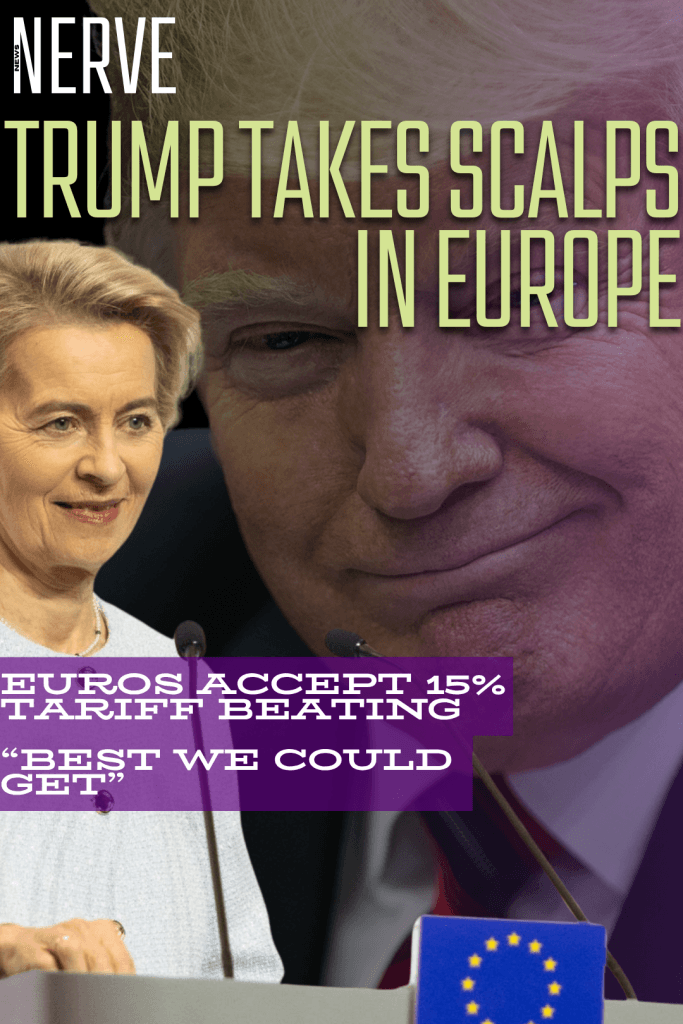

US-EU Framework Trade Deal Finalized in Scotland

President Donald Trump and European Commission President Ursula von der Leyen announced a framework trade agreement at Trump’s golf resort in Turnberry, Scotland. The deal narrowly avoids a looming transatlantic trade war by imposing a 15% import tariff on nearly all EU goods entering the United States.

In years past, the European Union enjoyed a modest average 1.5% tariff when considering all categories of goods (with many crossing the border duty-free). While the 15% rate is an increase from the 10% universal baseline Trump imposed globally at the start of his term, it is a far cry from the 30% he had threatened to apply to the European bloc had they not come to an agreement with the United States by August 1.

The agreement represents a significant de-escalation in trade tensions between the world’s two largest economies.

Together, the EU and the US are a market of 800 million people.

— Ursula von der Leyen (@vonderleyen) July 27, 2025

And nearly 44 percent of global GDP.

It’s the biggest trade deal ever ↓ https://t.co/rG3cHebXEk

Tariff Structure and Key Exemptions

The 15% baseline tariff will apply to the majority of EU exports, including automobiles, pharmaceuticals, semiconductors, and other industrial sectors. For the automotive sector specifically, this represents a reduction from the 25-27.5% tariffs that German carmakers like Mercedes, BMW, and Audi had been facing since April 2025. Von der Leyen emphasized that this “15 percent is a clear ceiling. No stacking. All-inclusive.”

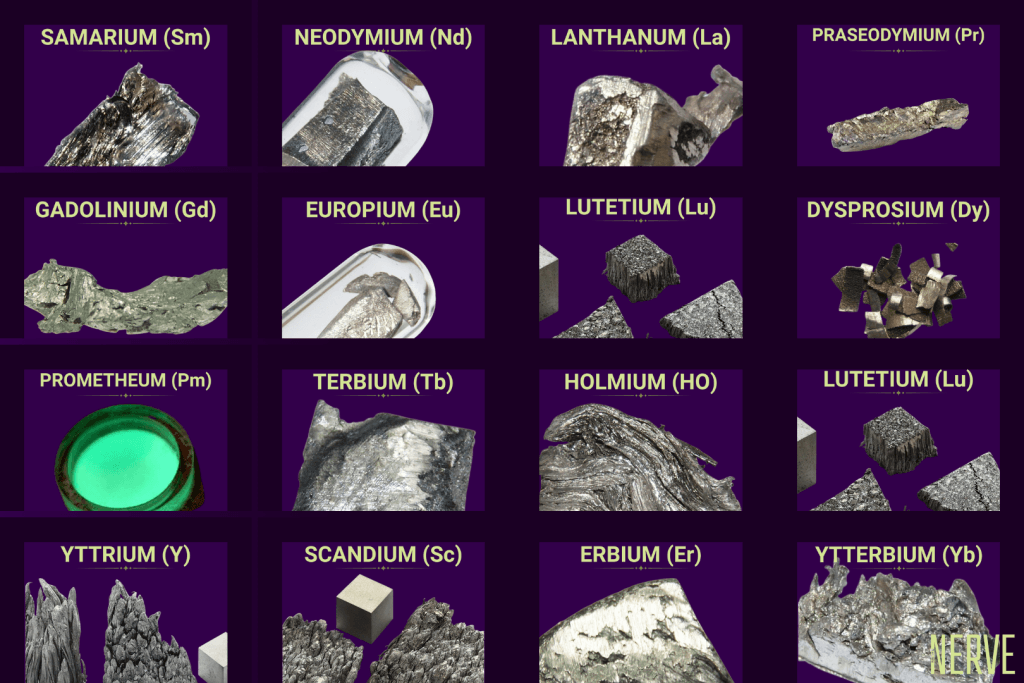

However, the framework includes important exemptions through “zero-for-zero” arrangements that apply to strategic categories including aircraft and component parts, certain chemicals, semiconductor equipment, generic drugs, select agricultural goods, and critical raw materials.

Steel and aluminum tariffs remain at elevated levels, though both sides agreed to explore new quota regimes to replace them later.

The tariff reduction represents a significant win for European manufacturers, particularly in the automotive sector. German Chancellor Friedrich Merz welcomed the agreement, noting the relief from what had been punitive rates imposed earlier in Trump’s term.

Massive Investment and Purchase Commitments

Beyond tariff reductions, the deal includes substantial economic commitments from the European Union. The EU committed to purchasing $750 billion worth of US energy products over three years, including liquefied natural gas (LNG), oil, and nuclear fuel. Additionally, European firms pledged $600 billion in investments into the US economy over the course of Trump’s second term, including purchases of American military equipment.

Trump characterized these commitments as part of the “biggest deal ever made,” telling reporters that “all of the countries will be opened up to trade with the United States at zero tariffs, and they’re agreeing to purchase a vast amount of military equipment.”

USTR Statement on the Deal

White House Fact Sheet

Strategic Implications and Market Response

The framework resolves significant trade uncertainty that had been weighing on global markets. Brussels had prepared extensive retaliatory tariffs targeting everything from beef and beer to Boeing aircraft and car parts, covering approximately $109 billion worth of US exports.

Financial markets reacted positively to the announcement, with Europe’s benchmark Stoxx Europe 600 index rising to its highest level in more than four months on Monday. The agreement provides much-needed stability and predictability for businesses on both sides of the Atlantic.

Mixed European Reactions

While many European leaders welcomed the avoidance of a trade war, reactions across the continent have been mixed. Italian Prime Minister Giorgia Meloni said the deal was “positive” but emphasized the need to see details before making a full assessment.

However, criticism emerged from some quarters. French Prime Minister François Bayrou called the deal a “dark day” for Europe, describing it as an unbalanced agreement where the bloc “resigns itself to submission.” Wolfgang Niedermark of the Federation of German Industries called it “an inadequate compromise,” warning that the 15% tariff rate “will have a huge negative impact on Germany’s export-oriented industry.”

Nationalist Economic Analysis: Energy vs. Manufacturing Strategy

From an America First perspective, the heavy emphasis on energy purchases raises important questions about optimal deficit reduction strategies. While the $750 billion in energy commitments represents substantial revenue for US producers, nationalist economists argue this approach may not maximize domestic job creation compared to alternative strategies.

Energy exports, particularly LNG and oil, are capital-intensive industries that employ relatively fewer workers per dollar of exports compared to manufacturing sectors. A typical LNG facility might employ hundreds of workers while generating billions in exports, whereas equivalent manufacturing exports could support thousands of jobs across supply chains.

Alternative approaches favored by economic nationalists include forcing European market access for American-manufactured goods, agricultural products, and services, sectors with higher labor intensity and domestic value-added content. Requiring EU purchases of American steel, machinery, consumer goods, or agricultural products could generate more widespread employment benefits across heartland manufacturing communities.

The $600 billion investment commitment partially addresses this concern, but critics note that much may flow to existing corporate expansion rather than new job creation. Nationalist analysts prefer trade deals that explicitly target industrial sectors where America maintains competitive advantages, such as aerospace, agriculture, and high-tech manufacturing.

However, energy purchases do offer strategic benefits aligned with nationalist priorities: they reduce European dependence on hostile nations, strengthen American energy dominance, and provide immediate deficit reduction without requiring complex market access negotiations. The approach also leverages America’s newfound energy abundance as a geopolitical weapon.

Looking Forward

While the announcement represents a significant breakthrough, experts note that “there is nothing on paper, yet,” with many details still to be clarified in the coming days and weeks. The framework establishes a foundation for ongoing negotiations that will determine the long-term shape of US-EU trade relations under the second Trump administration.

The deal demonstrates Trump’s continued use of tariff threats as a negotiating tool while showing European willingness to accept higher trade barriers to maintain market access and avoid a more damaging trade conflict.