A Critical Juncture in Global Trade

As European Union officials meet with Chinese counterparts in Beijing, industrial overcapacity has moved to the forefront of global economic discussions. Although the talks are formally between Brussels and Beijing, the implications extend far beyond. For the United States, this is not a peripheral issue. The outcome could directly impact industrial competitiveness, energy security, and trade enforcement frameworks for years to come. Washington cannot afford to treat these negotiations as routine diplomacy. The stakes are high, and the consequences will be felt across American industries and supply chains.

The urgency is heightened by the Trump administration’s ongoing push to realign global trade architecture. In recent weeks, the White House has announced a wave of new bilateral trade arrangements with key Asian economies, including Japan, Indonesia, and the Philippines. Although many of the deals remain light on formal detail, they represent a strategic effort to enforce tariffs, repatriate industrial investment, and penalize the transshipment of Chinese goods through third countries. These talks reflect a broader policy shift aimed at isolating China’s manufacturing base from global supply chains while building new trade frameworks that reinforce U.S. industrial strength.

A Longstanding Trade Concern

Industrial overcapacity is not a new issue, but it remains a pressing one. It occurs when a country builds significantly more production capacity than its domestic market requires, often through state subsidies and policy support. The result is a surplus of goods sold abroad at artificially low prices, which disrupts fair competition and damages global supply chains.

The United States has dealt with the consequences of this dynamic for years. Industries such as steel, aluminum, and solar have seen domestic production squeezed, jobs lost, and international disputes drag on over anti-dumping rules. The persistence of these conditions makes it essential for U.S. policymakers to remain vigilant. The administration’s most recent trade negotiations aim to mitigate these effects by instituting strict tariff frameworks and redirecting capital flows.

Strategic Industries in Focus

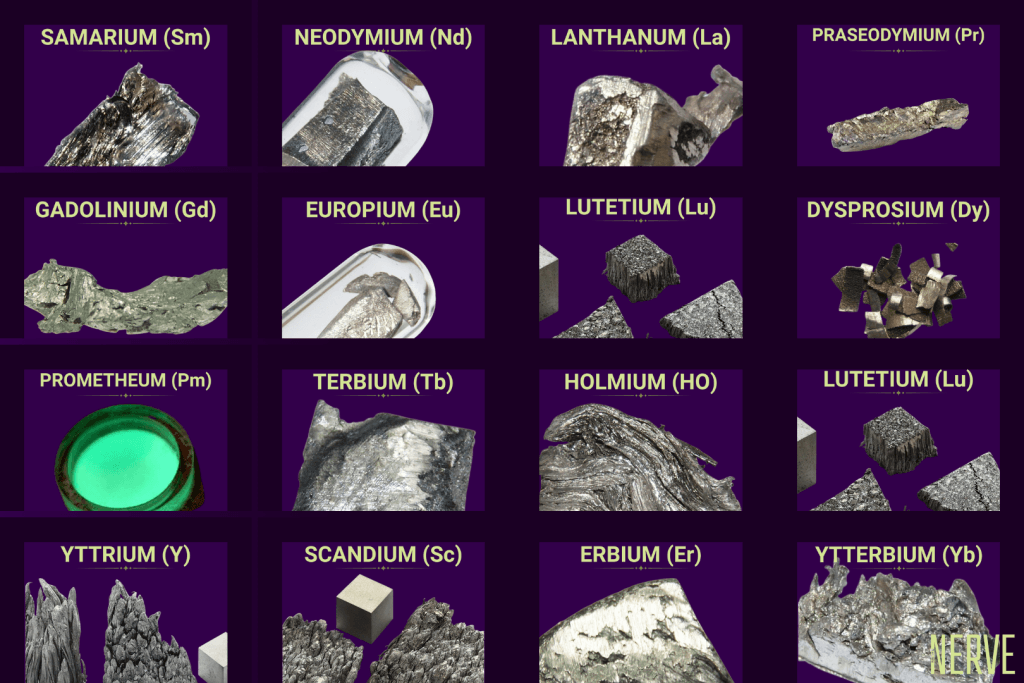

Today, the issue of overcapacity is shifting into sectors with national strategic importance. Discussions between the EU and China now center on electric vehicles, solar panels, and wind turbines. These products are critical to energy infrastructure and industrial competitiveness.

China’s rapid scale-up of production in these areas, backed by state direction and support, poses a direct challenge to countries attempting to rebuild or expand domestic manufacturing. U.S. lawmakers and agencies are closely tracking this trend because it threatens the viability of long-term industrial policy efforts. These efforts now include new bilateral agreements that direct foreign investment toward U.S. sectors such as energy, pharmaceuticals, and mineral processing.

If market conditions are distorted before new domestic industries can take hold, the opportunity to establish resilient supply chains and technological leadership may be lost.

Transatlantic Coordination Under Scrutiny

As Brussels engages Beijing, Washington is assessing the potential for a united front. Both the EU and the United States have designated China a “systemic rival,” but their levels of response have not always been aligned.

China often seeks to negotiate separately with Western powers to reduce coordinated pressure. Whether the EU takes a stronger stance or accepts partial concessions will shape the broader Western ability to respond to unfair trade practices. The United States is now advancing an explicit agenda to discourage transshipment and incentivize alternative sourcing. The alignment or misalignment of the EU’s actions will determine whether that pressure is reinforced or diluted.

Implications for U.S. Industry

The outcome of these talks will not remain confined to diplomatic circles. American companies and workers will feel the effects. From price stability and supply security to innovation incentives and infrastructure development, the stakes are high.

A failure to address overcapacity may leave American firms vulnerable to further market disruption. A constructive and assertive EU response could instead support shared goals and contribute to a fairer and more stable international trade environment.

The Trump administration’s bilateral strategy suggests a longer-term vision. That vision includes reducing exposure to Chinese production across critical sectors while securing preferential terms from aligned partners. As this strategy unfolds, EU cooperation or the absence of it will significantly affect its success.

In short, Washington has every reason to watch closely and act accordingly.